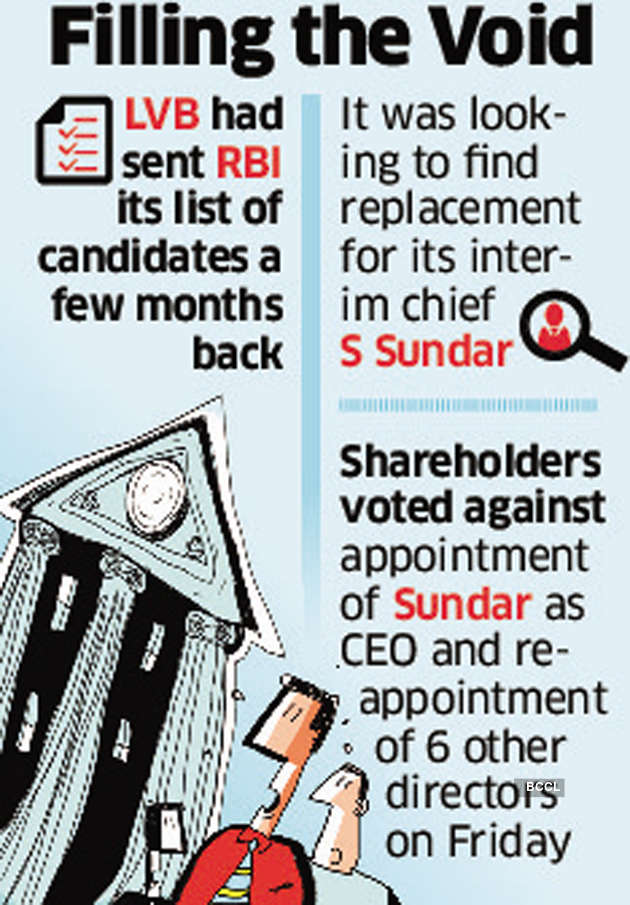

“We are given to understand that the regulator may consider the existing list for selecting the next CEO for the bank,” one of the persons said, adding that the RBI was not happy how shareholders had rejected a CEO appointed by it.

Shareholders of Lakshmi Vilas Bank, led by institutions, unexpectedly voted against the appointment of Sundar as chief executive as well as the reappointment of six other directors on Friday. The bank is ailing with negative tier 1 capital and nearly one-fourth of its loan assets having turned into non-performing assets (NPAs). Shareholders alleged that part of the accountability for the bank’s deteriorating performance over the past few years rested with them. The turmoil may delay talks on the bank’s proposed merger with the Clix Group.

One of the candidates in the list is experienced at handling the stressed corporate portfolio as well as restructuring and recovery of loans, which will come in handy in any turnaround exercise at Lakshmi Vilas. The bank’s gross NPA ratio jumped to 25.4% at the end of June from 17.3% a year ago, with the net ratio deteriorating to 9.64% from 8.3% over the same period.

Sundar, who was chief financial officer of the bank between April 2018 and December 2019, took over as interim CEO on January 1 to fill the void created by the sudden resignation of Parthasarathi Mukherjee, who stepped down on August 31 last year.

The RBI did not respond to queries.

On Sunday night, the RBI approved a plan under which day-to-day affairs of the bank will be run by a committee of directors (CoD) comprising three independent board members, whose reappointment was approved by the shareholders.

This CoD will exercise the discretionary powers of the managing director and CEO. The members of the committee are Meeta Makhan, Shakti Sinha and Satish Kumar Kalra. Makhan has been selected as chairman of the committee.